1. THE STARK PRESENT

The summer of 2023 has drawn to a close. The pandemic is in the lull, ‘normality’ has resumed but the grim atmosphere has not disappeared. The climate crisis is getting worse, disasters attributed to “Mother Nature” dominate the news. But the economic crisis also proliferates. What both crises have in common is that they affect people very unequally. They show that we live in a class society.

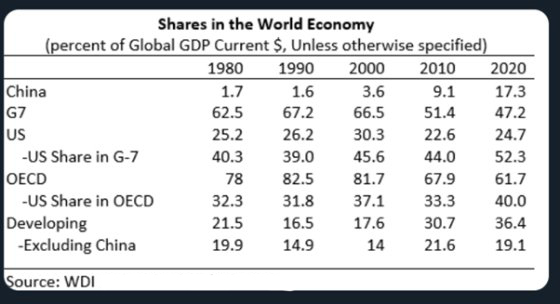

The Dow Jones, the so-called barometer of the US economy, has been doing quite well. Those with a lot of money can still make it grow. The rest of us are doing less well. Inflation is eroding wages. Millions of Americans are currently losing their health insurance. There are increasing numbers of homeless people. The gap between rich and poor is widening in every country, but globally, the gap is deepening between countries capable of playing a competitive role in the ultra-productive information economy and all the others.

Mass flight from poorer countries is the result. The information revolution has unified the global economy but at the same time it is expelling many. The deeper the global crisis sinks and the more the information technology increases productivity, the more ‘superfluous’ people there are. It is therefore predictable that their numbers will continue to grow. Migrants are welcome in the highly developed countries where productive capacity is concentrated, because of the ageing population and to counteract wage growth by increasing the labor supply. But when too many come in, the system shows its true face. The cruelty with which migrants have been treated recently defies the imagination. Texas placed murderous barricades in the river separating the state from Mexico. Saudi border police killed hundreds and possibly thousands of migrants and their families, according to Human Rights Watch. Tunisia dumps refugees in the Sahara desert. In Libya, many are tortured and sold as slaves. The EU pays Tunisia, Libya and Turkey hundreds of millions to keep refugees out of fortress Europe. Yet more than 26,000 have reportedly drowned in the Mediterranean Sea since 2014. Nevertheless, they keep coming, more than ever. Hounded not only by hunger and climate disasters but also by the lack of opportunities, the hopelessness, insecurity, corruption, war and general hopelessness that are byproducts of the crisis of global capitalism.

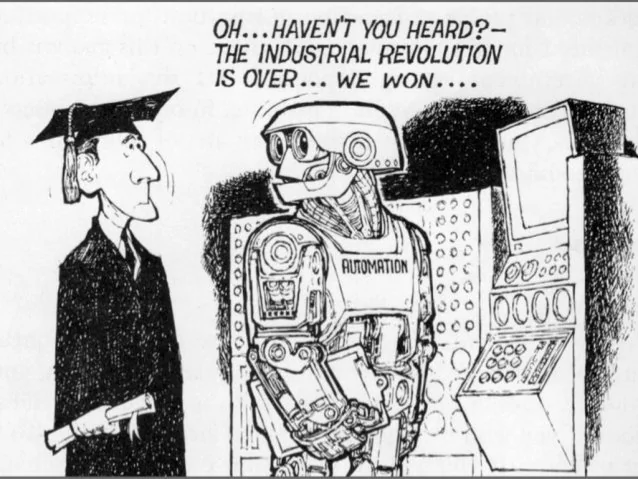

That US stock markets, meanwhile, are doing well despite the fall in profits (minus 7.1% in the second quarter of this year) is largely due to the radiating success of a dozen or so companies that hold dominant positions in the information economy. The expectation of high profits is currently driven by the rise of AI, Artificial Intelligence, the technology that is improving itself as it goes along, by processing massive amounts of data. Nvidia, the largest producer of AI chips, saw its revenue more than double in the second quarter and its profits rise ninefold, to $6.2 billion. Demand is huge. According to a study by OpenAI (the company that designed ChatGPT), AI would have a productivity-boosting impact on 80% of all US jobs. So this new phase in automation has implications for almost all sectors of the economy. Everyone must join in, integrate AI, because those who do not fall behind, lose competitiveness. Only those who get on board can survive.

Of course, there are also implications for the military sector.

War preparation

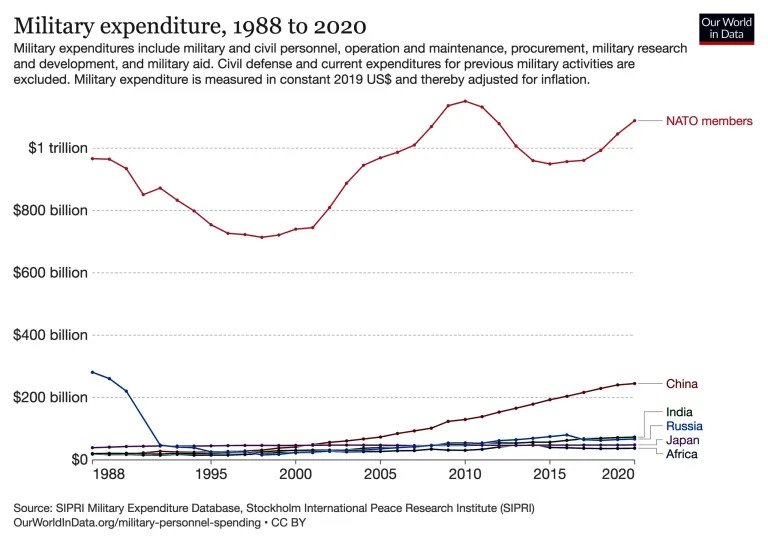

Another global trend stands out: just about everywhere, governments are increasing military budgets and cutting social spending. Apparently they all see a rising probability of war and want to prepare for it.

The trend is perhaps clearest in China where, despite the current slump (growth stalls, the long-predicted deflation of the real estate market spreads to the whole economy with disruptive consequences), the military budget has increased by 7% while unemployment support and other benefits have been axed.

In the US, food stamps, child care subsidies and other social spending are cut while the Pentagon budget is up 4.1%. Together with military spending by other departments such as Energy, the US now spends nearly a trillion dollars a year on its military.

In Europe, too, the pressure is on to cut social spending and increase armament spending. This is necessary, we are told, because of the Russian threat. Those who claim this should explain the following chart:

The distance has not narrowed in the last two years. In 2021, NATO countries’ military spending was 15 times greater than Russia’s. In 2022, European military spending grew by 13 percent, the biggest increase since World War II.

Russia obviously had to step up, as a significant part of its arsenal has been destroyed or consumed in Ukraine . Arms factories are running at full capacity but cannot keep up with demand. According to Western military experts quoted in The New York Times, almost a third of Russia’s commercial economy is converted to in arms production. Production of ammunition and tanks is now twice what it was when the war began but consumption has risen even faster. Putin even had to turn to North Korea to import ammunition. He has been trying to shield especially the urban population in Russia from the war which cannot be called a war but he is succeeding less and less. In part because of rising inflation. But also because the toll of the war is growing steadily. According to UN estimates, there were some 300,000 casualties on the Russian side and 200,000 on the Ukrainian side so far, but that figure is rising fast. The Ukrainian counteroffensive is “slow and bloody”, as the US top general Mark Milley put it. The war is now being fought mainly with drones, missiles, artillery and landmines. It is a slaughter, day after day, but for the honor of a flag, there cannot be enough blood shed.

But it is a stalemate. According to US experts, the war could go on for years. That the Ukrainian army was able not only to halt the advance of the Russian army but also to reconquer some territory we can partly attribute to Ukrainian heroism (or rather nationalist stupor) but more decisive was undoubtedly the input of American ‘intelligent’ weapons. Such an intelligent weapon, for example, is the HIMARS missile, which contains microchips that guide it to its target and, on its way, picks up signals from microchips in satellites that adjust the missile’s course if the target changes position after the missile has been fired. Compared to such precision weapons, Russia’s arsenal is hopelessly outdated.

2. “STRANGLE WITH INTENT TO KILL”: THE CHIP WAR

Computer chips (semiconductors) are thus a major key to power in our time, both militarily and economically. You sometimes hear it said that they are the new oil. The comparison is flawed but it is true that chips are now as essential to the production process as fossil fuels. And while attempts are made to curb the consumption of oil1, the use of chips is growing rapidly. There are many billions of chips in the things we use every day: cars, telephones, washing machines, refrigerators, televisions, ovens, and so on: there is virtually no industry or administration today that does not use chips. But one chip is not the other. The first chips to hit the market in the early 1960s contained 130 transistors each. An Apple iPhone chip today contains 114 billion of them and many other components. And that is small potatoes compared to so-called advanced chips whose components are incredibly small and can process gigantic amounts of data at lightning speed. They are essential for AI, but for everyday use in consumer products, less sophisticated chips suffice.

A chip is a ‘wafer’ (a semiconductor) usually smaller than a postage stamp that consists mainly of layers of silicone into which many circuits are laser-cut. These circuits are opened or closed by a transistor, a ‘switch’ that turns them on or off. When on, the circuit produces a 1, when off, a 0. All those 1s and 0s form digits that are instructions for the software, data storage and other functions. The smaller the transistors, circuits and other components, the more can be put on a chip and the more complex tasks the chip can handle. The latest chips are barely comparable to those of 50 years ago and can handle hundreds of millions of operations per second. The most advanced chips have components smaller than 10 nanometers (a nanometer is one millionth of a millimeter. One inch= 25,400,000 nanometer). No industry has ever developed so quickly. Chris Miller jokes in his book “The Chip War” that if aviation had made equally rapid progress, “aircraft would now be flying twice as fast as light”.

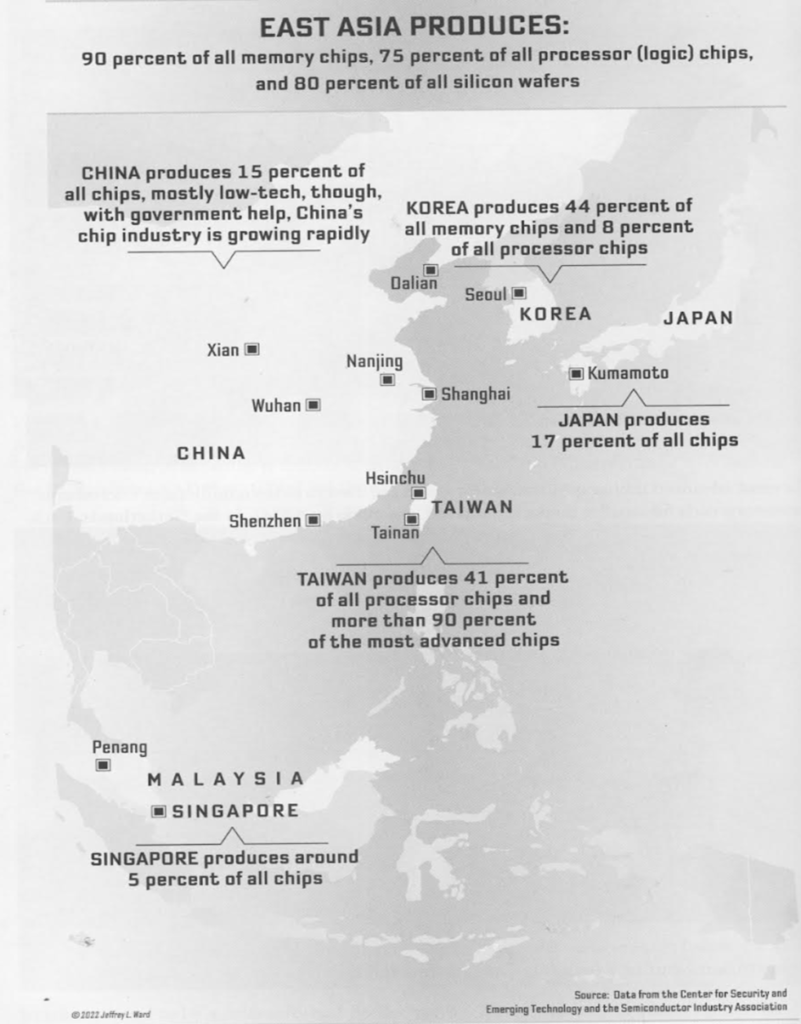

The biggest consumer of chips is China. It uses more than 70 % of world production and produces only 16 % of it itself. It spends more on chip imports than on oil imports: over $400 billion a year. China needs so many chips because of its crucial role in the global economy: as everyone knows, it became “the factory of the world” where an awful lot of consumer products are made or assembled. Not only consumer articles but also, increasingly, technology. All products with chips in them, made with machines with chips in them. But of the profits made from those products, China sees only a fraction.

The global world order is based on an international division of labour. In the chip industry, the most typical one is as follows: chips are designed in the US, made in south-east Asia, processed into products in China that are sold by US companies. Of course, this is a gross simplification that ignores the role of European companies, among others, but it is the basic picture. This map illustrates this concerning chip manufacturing:

Early chipmakers like Intel designed and made chips but soon found it was cheaper (lower labor costs) to outsource production to Asia. Apple, for example, has its chips made by TSMC in Taiwan, after which they are assembled along with many other components by Foxconn and other companies in China. The designer controls the final product and pockets the extra profit his new product temporarily generates. The manufacturing cost of an iPhone 15 Pro is less than $500 (Apple’s own costs included) but the market price is $1,199. Apple can charge that price because it has a quasi-monopoly. Because there is nothing like the Apple 15 Pro. Unless of course soon the Apple 16 Pro.

As long as China stuck to its task within the global production chain, there was no problem. From the point of view of Western capital, globalisation was good for everyone. America was fine with moving much of its manufacturing to China; it provided cheap products that kept inflation low and grew an affluent bourgeoisie and middle layers in China, an eager market for Western products.

But it did not escape China where the big profits are made. Not in the intermediate role it was assigned but by climbing up the high-tech ladder. To keep a bigger share of profits at home, China had to ramp up its own chip production. And then design and make its own advanced chips and integrate them into its production process and military technology. On the latter, the Russian military’s vulnerability to Nato’s precision weapons has convinced Chinese military leaders more than ever of the importance of advanced chips in contemporary warfare.

Biden on the attack

China does not produce advanced chips for now and never will, the US has decided. Eight years ago, China unfolded a plan to become self-sufficient in chip production in 10 years (which is doomed to fail) and to design its own advanced chips. Over $190 billion was set aside for that purpose. Alarm was raised in Washington. The rising tensions with China since then have had to do with more than just chips but chips do play a big part in the story.

The turnaround began in the final years of Obama’s administration and accelerated abruptly when Trump came to power. “We can’t continue to allow China to rape our country’,” the new president said and promptly raised tariffs on a whole range of Chinese products. The tone had already sharpened under Obama, who in 2015 banned Intel from selling advanced Xeon chips to companies suspected of ties to the Chinese military. But the Trump administration was the first willing to interrupt the global supply chain to slow China’s technological advance, even though some US companies suffered. This was most evident in 2019 when Washington blacklisted Huawei, the world’s largest producer of telecommunications equipment, as a company with whom US firms are forbidden to trade. A year later, that prohibition was extended to all companies in the world that use US machinery or software. There are none in the high-tech sector that don’t. As a result, Huawei could no longer import chips for its smartphones and other products, and its plan to build the global infrastructure for the 5G internet failed. By 2022, its shares had fallen to 2 percent. Smaller Chinese firms blacklisted suffered the same fate.

Biden tightened the screws. While Trump set his sights on specific companies, his successor targeted the entire sector. On October 7 last year, he launched his technology offensive with a global ban on the sale of AI and other advanced chips to China. Not only the chips themselves but also the software to design them, the machines to make them and the machinery to make those machines were denied to China. And even for non-advanced chips, such as those for Apple iPhones or GM cars, companies, wherever they are based, must seek permission from Washington to export them to China. Another ban was added last month: no one is allowed to invest in China’s domestic chip production development any more.

This does not mean that China has been put on dry seed when it comes to importing ‘ordinary’ chips. China may well continue to play its role of ‘factory of the world’ but it may not climb any higher. ” It is as though the United States is saying to China “AI technology is the future. We and our allies are going there. You can’t come”’, writes Gregory Allen, the director of the AI project at the Center for Strategic and International Studies.” He calls the measures “the beginning of a new US policy of actively strangling large segments of the Chinese technology industry—strangling with an intent to kill”. Martin Wolf wrote in The Financial Times that Biden’s measures are “‘far more threatening to Beijing than anything Donald Trump did. The aim is clearly to slow China’s economic development. That is an act of economic warfare. One might agree with it. But it will have huge geopolitical consequences..”

The US government can do this because all phases of chip production are controlled by US capital. That does not mean that non-US companies do not play an important role in it. The production chain is very international. But the non-US companies are all dependent on the US, as customers or as suppliers of software and hardware. Chris Miller points out that oil and chips are very different in that respect. Oil, and the technology to extract and refine it, can be bought from many countries. Despite OPEC, there is competition. But the production chain of chips and especially advanced chips depends on a series of quasi- monopolies: the machines, chemical components and software are often produced by just a few and sometimes just one company. Those companies are based in the US or in countries close to it. America controls the bottlenecks. And as in China, it is the state that determines what companies can or cannot do. State capitalism is a global phenomenon. But unlike Beijing, Washington can impose its rules on the whole world. No company in Europe or Asia would dare to violate them. Only the US has that power and at all costs it wants to prevent China from acquiring it.

3. WHAT CAN CHINA DO?

Preventing China from breaking US economic and military dominance is almost the only thing Democrats and Republicans can agree on. The chip offensive frames that goal. It implies a (for now only limited) de-globalisation. Profitable transactions with China are prevented. And the ‘Chip act’ approved by the US Congress last year invests $54 billion in domestic chip production that will create a more expensive version of existing foreign production capacity. From an economic point of view, these steps are counterproductive. For this very reason, coupled with rising armament, they are ominous.

China is trapped

For China, the chip war is disastrous. Even if it manages to design advanced chips of its own, it cannot make them without the ultra-complex technology of the US, Japan, Taiwan or the Netherlands 2. Of course it invests massively in developing its own advanced chip industry. And of course it will use smuggling and espionage to try to acquire high tech from other countries. Can it defy expectations and create a full-fledged chip technology despite the US embargo? If any country is up to such a challenge, it might be China. Huawei’s recent success illustrates that. After nearly being crushed by Trump’s embargo, it climbed out of the doldrums by investing heavily, with state aid, in research and developing new products, including a new smartphone, the Mate 60 Pro, to compete with Apple.

China’s meteoric development this century shows it can amaze the world.

But that development was possible because it gave up its attempt to grow in an autarkic, self-sustaining way, and fully integrated itself (with America’s blessing )into the global economy. Withdrawing (of necessity) from the global production chain can only have the opposite effect. As Chinese chip technology improves, the international, American-controlled chip industry also advances. If it keeps up the pace of progress in computing power over the last half century, the gap will only widen, whatever China does. Technological autarky is more impossible than ever.

A counter-attack?

Can China take countermeasures? After all, it is an important market for America too. For Apple, for example, it is the second largest buyer of iPhones after the US itself. As if to remind America of this, Beijing recently banned the use of iPhones by its government employees, allegedly for security reasons. Biden had the audacity to claim that this shows China is trying to “change the rules of the game”, even though it is only a jab compared to his own salvo.

It cannot be more than a jab for now. China is too fragile to wage a trade war: It is far more dependent on its foreign markets and suppliers than the US. What the US and its allies need from China they can, if not without problems, obtain elsewhere, but not vice versa.

China’s quasi-monopoly over some raw materials of chips and other components such as batteries, gives the impression that it has an important weapon to pressure America and its allies. This is especially true of so-called rare earth elements (REEs), a group of 17 metals that are indispensable for the production of electric cars, smartphones and guided missiles. China produced 71% of the world total last year. It is also the largest producer of gallium and germanium, minerals used in the manufacture of semiconductors and radars, among others.

On closer inspection, however, rare earths turn out to be less rare than the name suggests. They occur in numerous countries but never in pure form. Because they are mixed with other metals, they need to be refined and this is done mainly in China. The US used to be the largest producer of rare earths. Because the refining process is very polluting, it was diverted to China. It would not be an insurmountable problem to start it up in other countries. The same goes for the other minerals such as gallium.

In 2010, China restricted rare earth exports to Japan, as a sanction for a skirmish over an uninhabited island that both countries claim. Japan had little trouble obtaining the needed raw materials elsewhere. Last July, China announced export restrictions on gallium, in response to the Biden embargo. The West shrugged its shoulders. There are plenty of alternative sources for gallium.

A silicon shield?

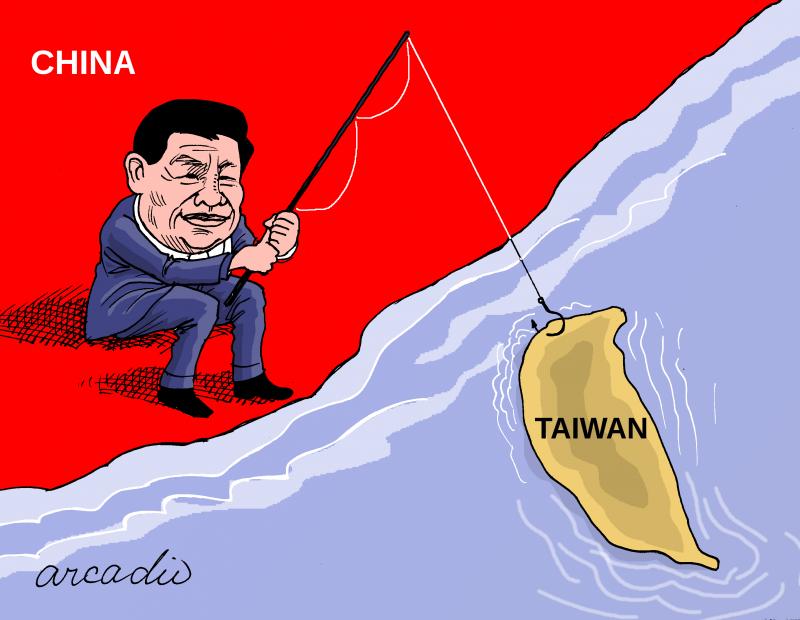

It just so happens that over 90 per cent of advanced microchips are made right under China’s nose, on an island that Beijing considers a rebellious province. Taiwan operates giant factories that not only make most advanced chips but also 41 per cent of all processor chips. Most are owned by the giant TSMC. TSMC does not design chips but makes them for everyone.

In the current circumstances, Taiwan must seem more than ever an attractive booty for China’s leaders. Chinese control of TSMC would change the whole power picture. But an invasion, of course, would mean a horrible war. Even if it were militarily successful, it is hard to imagine that the chip factories would remain intact. And even harder to believe that Taiwan’s chip industry would continue to run and export during such a war. According to Chris Miller, the loss of Taiwanese chips would plunge the global economy into a deep depression. He points out that the US auto industry suffered $200 billion in losses in the 2020-2021 pandemic years due to interruptions in TSMC’s production. Not only the US depends on Taiwanese chips, so do Europe, Japan and China. The entire world industry needs TSMC.

Nobody has any interest in Taiwanese chip production being halted. Neither China nor the US. That is considered Taiwan’s “silicon shield”. But Washington still finds it necessary to add a sword to that shield, as evidenced by recent efforts to strengthen military ties with Japan, South Korea and even Vietnam. With stick and carrot, it has also persuaded TSMC to build a factory in Arizona.

Chris Miller also has his doubts about the durability of the silicon shield. His fear is that the logic of war could overwhelm the economic logic. Making profit is what makes the global economy run, and a war over Taiwan would undoubtedly have extremely negative consequences on that. The economic and social disruption would be a thousand times greater than what the war over Ukraine caused. That makes the likelihood of a Chinese invasion in the short term very unlikely.

But circumstances change. If the crisis deepens and nationalism seems the only means of keeping the lid on the pot, if Western pressure continues to grow and the technological gap between China and the West continues to widen, the opinion may gain traction among Chinese rulers that it is better to strike before it is too late. As Putin thought in February 2022.

4. AI’S ‘BRAVE NEW WORLD’

It may be reassuring that Taiwan’s chip industry is too important to both China and the US to risk war over the island in the next few years but in the longer term it is no guarantee.

The production capacity of Taiwan can be duplicated in other countries. Steps are being taken in that direction – not only by China, new chip factories are also being built in the US and Germany – but even in the most optimistic scenario, it would take many years before Taiwan’s chip industry is no longer indispensable.

But the socio-economic context in which rulers make decisions about war and peace is also changing. Chips play a role in that too. New-generation chips, generative AI in particular, are accelerating automation. According to Sundar Pichai, Google’s CEO, AI will bring a bigger change in people’s lives than electricity or fire. That may prove to be an overstatement but the impact on employment will be profound. OpenAI predicts that this time, it is mainly white collar workers and other skilled professions that will suffer. According to OpenAI’s research, AI could take over some or all tasks in 80 percent of all occupations. Investment bank Goldman Sachs believes that 300 million full-time jobs would be lost as a result. AI would then do a quarter of all the work that currently exists in the US and Europe, according to the bank. Carl Benedikt Frey, an Oxford professor who studies the future of work, believes it is impossible to know how many jobs AI will eliminate but it seems certain to him that AI will bring a pay cut. When GPS came on the scene, knowledge of the streets of major cities no longer became a requirement for taxi drivers. This made room for platforms like uber, and taxi drivers suffered a huge pay cut. Such a process is made possible by AI on a broad scale, according to Frey. Knowledge and expertise will be downgraded if machines have it too and more of it.

In terms of job satisfaction, Charlie Warzel writes in The Atlantic that the introduction of AI will mean that we will be expected to produce and behave even more like robots.

Goldman Sachs speculates that there also will be many new jobs created. Primarily in computing. But this sector, and chip production in particular, is very capital-intensive. It requires little living labor compared to the cost of the technology involved. A microchip ‘printer’ costs $100 million, the latest model $300 million. Opening a chip factory requires a $20 billion investment and creates at most a few thousand jobs. Because the chip industry is at the front of capitalist development, it is perhaps the clearest expression of its general tendency, described by Marx. What he called the rise of ‘the organic composition of capital’ means that the production process involves ever more technology, infrastructure and materials, and, relatively, ever less labor power. The value of the commodity therefore expresses ever more the value of the technology and materials that are used in its production and ever less that of the labor used.3 And that’s a problem for capitalism. The threshold, the amount of capital that is needed before production can begin, keeps rising. More importantly: since the origin of profit is unpaid labor, surplus value, if the share of labor’s value in the product’s value shrinks, the share of surplus value, and thus profit, must shrink as well, since unpaid labor is but a part of the total expended labor power’s value. And yet the profits of the chip industry are higher than average. That requires an explanation.

A monopoly game

Goldman Sachs expects AI to increase productivity by 7 percent. If that would turn out to be a correct estimate, that would counter-act the tendency to lower average profit-rates to some degree. It would mean lower labor costs per product, more room for profit. To the degree that the value of what workers buy with their wages becomes a smaller part of the value produced in a working day, the rate of exploitation would rise. That would stimulate profit-rates. But such a leap in productivity would also mean an enhancement of the scale of production and thus further increase overproduction, which would drag profits down.

Especially the weaker competitors would suffer. The big profits would only gained by those companies that are at the forefront of the transformation and which therefore reap a “technological rent”. They make extra-profits because their technological edge gives them a full or near monopoly. An example we mentioned earlier: AI chipmaker Nvidia saw its revenue double in the second quarter of this year and its profits rise ninefold, to $6.2 billion. You would think, if revenue doubles, so do profits. So why is it that profits increased not twice but nine times? Because the ratio of costs to selling price has changed. Nvidia has a monopoly, which means that the market price of its product is not reduced by competition to cost plus average profit.4 Depending on demand, the price can rise far above average. That, of course, is an enviable position in which any company wants to find itself. Hence the technological race. That is not an option but a compulsion.

In the chip industry and other high-tech sectors, monopolies and oligopolies are the rule. The same trend, accompanied by an ever-increasing concentration of capital, is seen in industries such as pharmaceuticals, mining, agribusiness and many others. Because they can command higher prices, their customers are left with less purchasing power for other products. In this sense, their extra-profits are an invisible tax on the rest of the economy. The breakthrough of AI will narrow the market for them, fuelling the trend towards overproduction and deflation.

The chip industry market, on the other hand, will continue to grow. Now demand is huge and it is unlikely to diminish because within two years or less there will be new models that are even more advanced, faster and more compact than current chips. And manufacturing processes will have to adapt to them with new hardware and software. Which will present many companies with a “damned if you do and damned if you don’t” dilemma: invest more and more in technology that will have to be replaced prematurely or fall behind, lose the competition.

AI is thus not a panacea that will save the global economy. On the contrary: it will deepen the crisis. In the literature on AI, quantum computers etc, you sometimes get the impression that the entire world economy runs solely on chips. Of course, there is so much more that determines production and the market. “For all that we are told we live in an increasingly dematerialised world where ever more value lies in intangible items – apps and networks and online services – the physical world continues to underpin everything else,” writes the economist Ed Conway in his new book Material World. “The world would not perish if Twitter or Instagram suddenly disappeared but if we suddenly ran out of steel or natural gas, that would be a different story,” he notes. Of course, the chip-based industry encompasses much more than Twitter (now X) and Instagram but he has a point. He points out that this “physical world” is increasingly unprofitable. The share of manufacturing, energy and mining in the US GDP has dropped to just one-fifth.

The other crisis

But even in the “physical world”, companies are obliged to grow or perish. To increase their productivity, to produce more with less labour, or to pay that labour less. This compulsion for growth implies that the climate crisis will get worse and worse in the years to come.

Those who believe that windmills, solar panels, electric vehicles and international conferences can turn the tide, are deceiving themselves. The plundering of the earth, environmental pollution and global warming continue unabated. In his book, Conway gives some stark examples:

– More resources were extracted from the earth’s crust in 2019 than in the entire period since the beginning of mankind until 1950 5. Even a switch to renewable energy implies more plundering of resources 6.

– The share of fossil fuels in energy supply remains more or less constant, hovering around 80 per cent of the total, same as at the start of the century. As that total continues to grow, it rises in absolute terms and so CO2 emissions also continue to rise.

– Plastic production continues to grow exponentially. More plastic has been produced in the last 13 years than in the entire period from 1907 when it was invented to 2010.

– Cement production accounts for more than 7 percent of total CO2 emissions. There are already more than 80 tonnes of concrete per earth’s inhabitant.

And so on. As if we’re blind or addicted. It is therefore predictable that the disasters caused by the environmental and climate impact of the growth compulsion will increase and affect more and more people.

A crossroads

When I mentioned China, the US, Europe or Russia, I did not mean the people of those countries but only their rulers, the managers of state and capital. Between the interests served by the rulers and those of the majority of their populations, there is an unbridgeable gap that is constantly glossed over in the media.

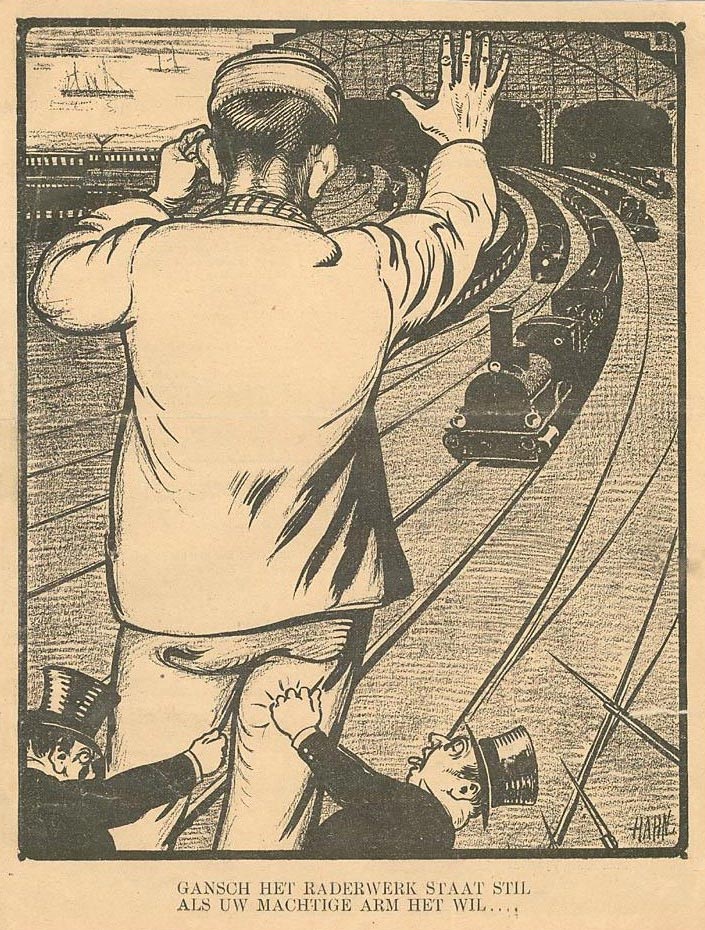

If we think about the future, we should ask ourselves not only what those in power will do but also how the powerless will react. Those powerless are potentially powerful because they make the whole machine run. Without them, war cannot be waged; without them, profits cannot be made. Their submission, their identification with their leaders, elected or otherwise, is an absolute requirement for the latter to carry out their plans.

The context is the same for both classes: economic crisis, climate crisis, a widening gap between rich and poor, the number of ‘superfluous’ growing even faster due to automation, resulting in unemployment and mass migration.

The likelihood that this context will drive the ruling class in several countries to war is real. War for control of resources, some of which will inevitably become scarce, war for control of markets, war to divert domestic tensions to a foreign enemy.

Whether the powerless will go along with this is unpredictable. Working class resistance may stop the madness but there is no guarantee. It can go either way. I was reminded of this recently by two interviews with American workers. The first took place during a demonstration in a New York neighbourhood where a vacant school was being used to house migrants. The anger of the crowd, stoked by the far right who portrayed the migrants as potential child molesters, was palpable. 7 One young worker declared to the cameras that he found it intolerable that the migrants were given free shelter and other assistance, while he had to pay for everything and was struggling more and more to support his family. I don’t think he would want to trade places with any of those desperation-driven migrants but I still felt some sympathy for him. Not for what he said (he was just regurgitating the racist, nationalist garbage that he was fed) but for his precarious situation. A recent report shows that half of NewYork households have too little income to meet their basic needs (up 14 percent from 2021). Even in this wealthy city, many are finding it increasingly difficult to make ends meet. But for the poor to blame each other for this while wealthy NewYorkers meanwhile get richer and richer is, of course, just what suits the ruling class.

The other interview was in The New York Times. A Ford worker manning a picket line said that for him the main purpose of the strike was to abolish the tiered wage system imposed during the 2008 crisis. This means that new workers get much lower pay (starting at $17 an hour) for the same work than those who were already working there before 2008. “We all labor hard,” he said. “You have a precise amount of time to do your job on the line, and our jobs are timed to the second. When the line starts, it doesn’t stop until we go on break. A lot of new hires come in and they have aches and pains, the same aches and pains that I have, so they should get paid the same as me.”

Those two workers indicate the choice: fight each other or fight together against those who exploit and oppress us. The misery of the migrant and the misery of the worker are caused by the same capitalist sytem. Only solidarity, across all the boundaries and divisions imposed on us, can save the world.

Sanderr

9/23/2023

NOTES

1 With limited success: While wind and solar energy’s share of global electricity production reached the 10 percent threshold for the first time in 2021, CO2 emissions rose 7 percent in the same year, due in part to higher coal consumption. Wind and solar provide only 3.3 percent of total energy consumption.

2 An example of the complexity: Advanced chips are made with EUV (extreme ultraviolet) lithography technology designed by the Dutch firm ASML. That uses lasers that create a plasma 40 times hotter than the surface of the sun. This emits extreme ultraviolet light (invisible to the eye) that, refracted by a series of mirrors, carves circuits and other components into the silicon chip. The lasers have 457,329 parts (made in different countries) and the entire EUV machine has more than 100,000 also very complex parts. And EUV is just one part of the manufacturing process that uses more than 500 machines and includes more than 1,000 steps.

3 That raises the question: how, in this industry, is the value of the technology transferred into the commodities? The value of the technology is the value transferred and created in its production: c+v+sv. This value is transferred in the totality of the commodities which will be produced with it. This will occur over a period of 10 years if, at the time that it is sold, the ‘social estimate’ is that it will function well for 10 years (before it is worn out). In that case, 1/10th of its value will be transferred in 1 year’s production and the technology then has 9/10 of its original value left. But when in the 5th year it must be replaced because newer, better technology has come along, half of its value can’t be transferred and is therefore lost. Marx called this ‘moral depreciation’. However, if at the time that it’s sold, the social estimate is that it will take only 2 years before it is outdated and will have to be replaced by new technology, its value must be transferred in only 2 years. While that makes this technology less useful, it increases the value (and price) of the commodities produced with it. In the high tech industry, it is increasingly the case that the pace of transfer of the value of constant capital is not determined by wear and tear but by the pace of technological innovation. This is most clearly the case for software, which has no wear and tear and whose reproduction costs are close to zero, so that it can only be profitable on the base of state-enforced intellectual property.

4 That doesn’t mean its market is endlessly expandabe. Just because Apple introduces a new iPhone, that doesn’t mean that all owners of an iPhone with a lower number rush out to buy a new one. The company increasingly has to rely on buy back campaigns, offering substantial rebates for trade-ins, a telltale sign of overproduction.

5 “Consider that for a moment. In a single year we extracted more resources than humankind did in the vast majority of its history – from the earliest days of mining to the industrial revolution, world wars and all.”

6 “Consider what it takes to replace a small natural gas turbine, pumping out 100 megawatts of electricity, enough for up to 100,000 homes, with wind power. You would need around 20 enormous wind turbines. To build those turbines you will need nearly 30,000 tonnes of iron and almost 50,000 tonnes of concrete, along with 900 tonnes of plastics and fibreglass for the blades and 540 tonnes of copper (or three times that for an offshore wind farm). The gas turbine, on the other hand, would take around 300 tonnes of iron, 2,000 tonnes of concrete and perhaps 50 tonnes of copper in the windings and transformers. On the basis of one calculation, we will need to mine more copper in the next 22 years than we have in the entirety of the past 5,000 years of human history.”

7 They got their way: by the order of a judge who observed “there is no such thing as the right of shelter”, the school was vacated. Now the migrants are staying in leaky, overcrowded tents. Or in the streets.